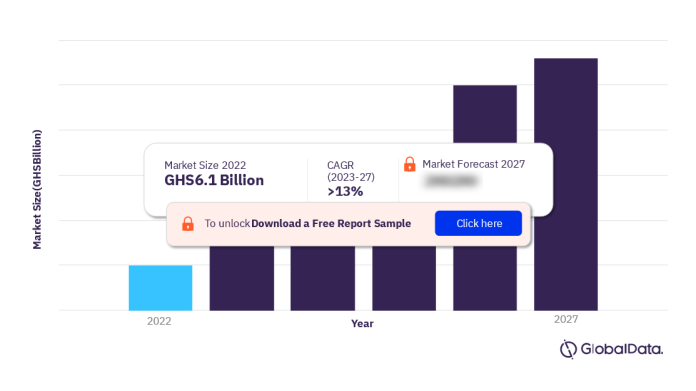

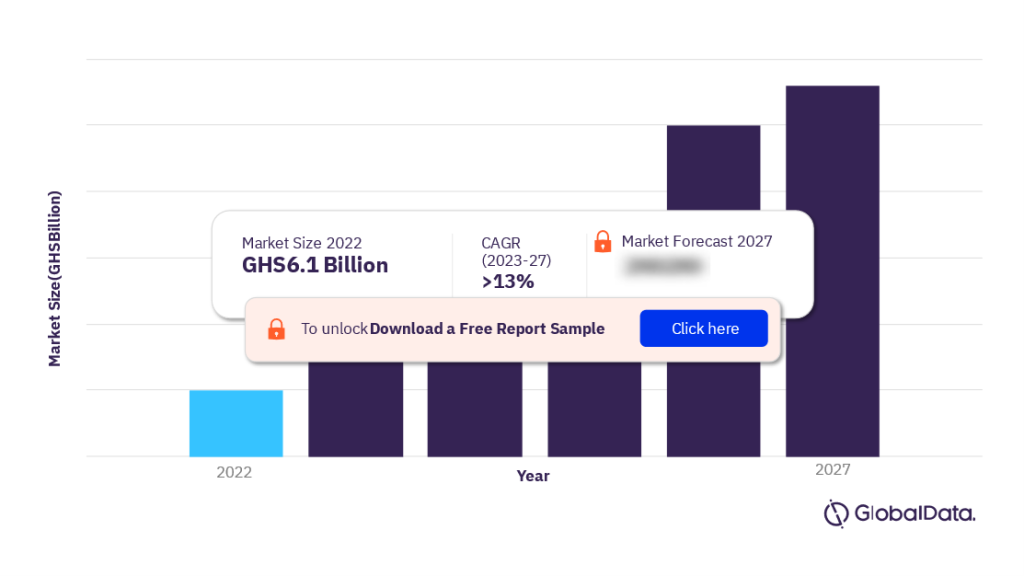

Insuring a Bright Future: Ghana’s Insurance Market Expanding and Evolving

Ghana, located in West Africa, has long been known for its vibrant culture and rich history. However, in recent years, the country has been making significant strides in the insurance sector, expanding and evolving to cater to the needs of its growing population.

Historically, insurance in Ghana has been seen as a luxury rather than a necessity. Many Ghanaians have been hesitant to purchase insurance policies, as they view it as an unnecessary expense. However, this perception is gradually changing as people become more aware of the importance of protecting their assets and securing their future.

One of the main drivers of the expansion of Ghana’s insurance market is the growing middle class and the increasing urbanization in the country. As incomes rise and lifestyles change, there is an increased demand for insurance products such as health, property, and motor insurance. People are now actively seeking ways to protect their investments, mitigate risks, and safeguard their families’ financial security.

The government of Ghana has also played a crucial role in promoting insurance in the country. Recognizing the potential of the industry, the government has implemented policies and regulations that aim to foster growth and innovation. This includes measures to strengthen the regulatory framework, ensure consumer protection, and encourage local participation in the insurance market.

Moreover, technological advancements have had a significant impact on the insurance industry in Ghana. With the rise of digitalization, insurance products and services have become more accessible and convenient for the population. Mobile technology has allowed insurers to reach remote areas and provide insurance solutions to previously underserved communities.

Insurance companies in Ghana have also embraced innovation and are adapting their operations to meet the evolving needs of their customers. They are investing in digital platforms, mobile apps, and online portals, making it easier for individuals to research, purchase, and manage insurance policies. This technological shift has not only made insurance more accessible but also more cost-effective, enabling insurers to provide competitive premiums and tailored coverage options.

Additionally, Ghana’s insurance industry is also witnessing the emergence of microinsurance and agricultural insurance. Microinsurance aims to offer affordable policies to low-income individuals and small businesses, providing them with protection against risks and helping them to recover from unexpected events. Agricultural insurance, on the other hand, helps protect farmers against weather-related risks and allows them to invest in their farms with confidence.

Despite the significant progress made, Ghana’s insurance industry still faces challenges. One of the main hurdles is the lack of awareness and understanding of insurance among the population. Many Ghanaians still do not fully grasp the benefits and importance of insurance, which hinders the market’s growth potential.

Furthermore, there is also a need for closer collaboration between insurance companies and other stakeholders, such as financial institutions and government agencies. By working together, these entities can develop innovative insurance products, provide financial literacy programs, and create a more conducive environment that encourages individuals and businesses to embrace insurance.

In conclusion, Ghana’s insurance market is expanding and evolving, driven by the changing demographics, government support, and technological advancements. As Ghanaians become more aware of the importance of insurance and insurers continue to innovate, the industry has the potential to play a significant role in shaping Ghana’s future. By insuring a bright future, Ghanaians can protect their assets, mitigate risks, and secure their financial well-being for generations to come.