Insurance for All: The Accessibility and Inclusivity Initiatives of Ghana’s Insurance Companies

Insurance is a fundamental tool that provides individuals and businesses with financial protection against the uncertainties of life. However, for many individuals in Ghana, accessing insurance coverage has been a challenge due to various factors such as affordability, lack of awareness, and limited access to insurance providers. Thankfully, Ghana’s insurance companies have recognized this gap and have been implementing a range of initiatives to ensure insurance is accessible and inclusive for all.

One of the main barriers to insurance coverage in Ghana has been the issue of affordability. Many Ghanaians, especially those in low-income brackets, have not been able to afford insurance premiums. To address this issue, insurance companies in Ghana have been developing low-cost insurance products tailored to the needs of these individuals. These products offer essential coverage at affordable rates, allowing more people to protect themselves against risks such as medical emergencies, theft, and accidents.

Another crucial aspect of accessibility and inclusivity in insurance is awareness and education. Many Ghanaians are unaware of the benefits and importance of insurance, which limits their ability to safeguard their assets and futures. Insurance companies have recognized this challenge and have been actively working to improve public awareness of insurance through various educational campaigns and initiatives. They conduct workshops, seminars, and community outreach programs to educate people about insurance and its benefits.

Furthermore, insurance companies have been leveraging technology to make insurance more accessible to all Ghanaians. With the rise of mobile technology and widespread internet connectivity, insurance companies have introduced mobile applications and online platforms. These platforms allow individuals to easily access insurance products, get quotes, compare policies, and even make claims, all from the comfort of their homes. This eliminates the need for physical visits to insurance offices and makes insurance more accessible to individuals living in remote areas.

In addition to affordability and access, insurance companies in Ghana have also been focusing on inclusivity, particularly in terms of gender and disability. They have been implementing initiatives to empower women and ensure their inclusion in insurance coverage. These initiatives offer specific insurance products designed to address the unique needs and challenges faced by women. Additionally, insurance companies have been working towards providing coverage for individuals with disabilities, recognizing the importance of inclusivity and equal access to financial protection for all Ghanaians.

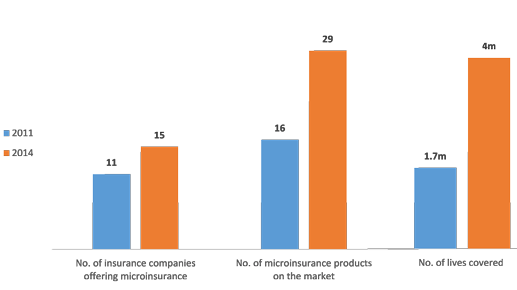

The efforts of Ghana’s insurance companies to make insurance more accessible and inclusive have yielded positive results. More Ghanaians now have access to affordable insurance coverage, making them better equipped to deal with unexpected events and uncertainties. The increased awareness and education campaigns have also resulted in a greater understanding of insurance and its benefits among the general population. Furthermore, the adoption of technology has made insurance more convenient and easily accessible, further breaking down barriers to coverage.

However, despite these remarkable strides, there is still room for improvement. Insurance companies need to continue tailoring their products and services to meet the diverse needs of Ghanaians. They must also work on strengthening partnerships with local communities and organizations to ensure effective outreach and education. Additionally, regulators and policymakers should continue to support these initiatives by creating an enabling environment and implementing supportive policies that promote accessibility and inclusivity in the insurance sector.

In conclusion, Ghana’s insurance companies have taken significant steps towards making insurance accessible and inclusive for all Ghanaians. Through initiatives focusing on affordability, awareness, technology, gender inclusion, and disability coverage, they have made significant progress in bridging the insurance gap in the country. These efforts are not only beneficial for individuals and businesses but also contribute to the overall economic growth and stability of Ghana. With continued dedication and collaboration, insurance companies can ensure that every Ghanaian has access to the financial protection they deserve.