Innovative Solutions: How Insurance Companies in Ghana Are Adapting to Changing Needs

Insurance has always played a crucial role in managing risks and protecting individuals and businesses from unforeseen events. Whether it’s health insurance, life insurance, or property insurance, the industry has continuously evolved to meet the changing needs of customers. In Ghana, insurance companies are no exception, and they have been embracing new technologies and innovative solutions to provide better services to their customers.

One of the significant changes that insurance companies in Ghana have been dealing with is the increasing demand for more affordable and accessible insurance options. With a significant portion of the population in Ghana employed in the informal sector, traditional insurance policies were often too expensive and complicated for many individuals and small businesses to afford. However, companies are recognizing this gap and are developing new microinsurance products that cater specifically to this segment of the population.

Microinsurance refers to insurance coverage designed for low-income individuals and families who typically earn irregular incomes. These policies are tailored to cover specific risks such as health emergencies or crop failures and are often offered through mobile platforms. By leveraging technology and partnering with mobile money providers, insurance companies in Ghana are bringing insurance coverage to the fingertips of individuals who previously had limited access to such services.

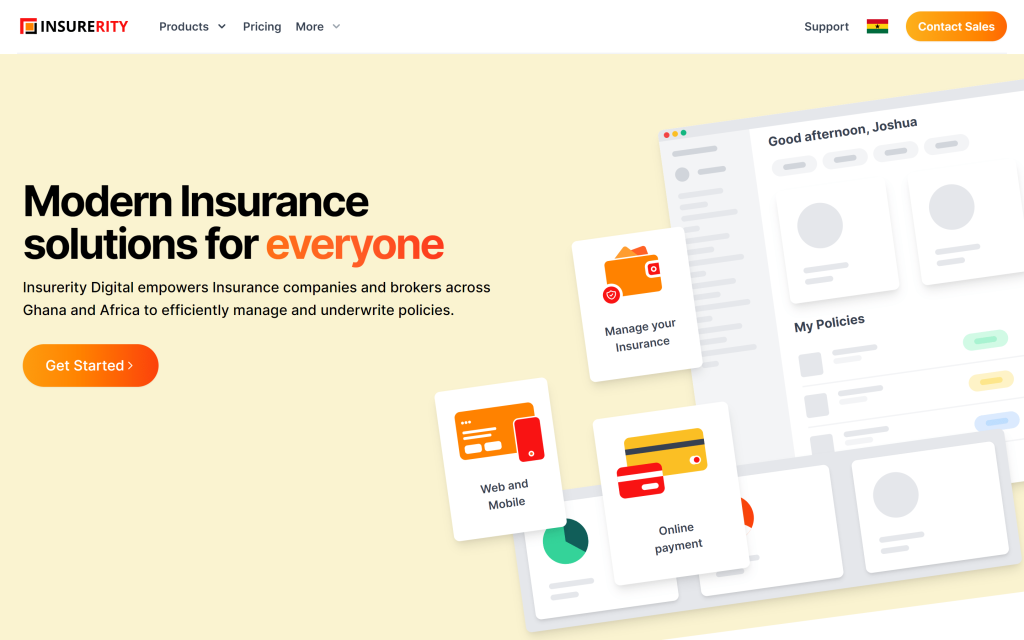

Moreover, mobile technology has also enabled insurance companies to simplify and streamline their operations, making it easier for customers to purchase and manage their policies. With mobile apps and online platforms, individuals can now compare different insurance products, calculate premiums, make claims, and access customer support at their convenience. These digital solutions not only offer a more seamless customer experience but also help reduce administrative costs for insurance companies.

Additionally, the rise of Insurtech startups in Ghana has been another catalyst for innovation in the insurance industry. These startups are leveraging technological advancements such as artificial intelligence, big data analytics, and blockchain to provide more tailored and personalized insurance solutions. For example, some companies are using AI algorithms to assess risk profiles and determine more accurate premium rates. Others are utilizing blockchain technology to improve transparency and efficiency in claims processing.

Another evolving need that insurance companies in Ghana are addressing is the growing demand for health insurance. With rising healthcare costs and an increasing awareness of the importance of health coverage, individuals and businesses are seeking comprehensive health insurance plans. Insurance companies have responded to this demand by offering more flexible health insurance packages that cater to different budgets and coverage preferences. Some companies are even introducing wellness programs and incentives to encourage policyholders to maintain a healthy lifestyle.

Furthermore, insurance companies in Ghana are also focusing on improving customer education and increasing awareness about the benefits of insurance. Many individuals in Ghana still lack knowledge about insurance products and their importance. To address this, companies are conducting various educational campaigns, seminars, and workshops to help individuals make informed decisions about their insurance needs.

In conclusion, insurance companies in Ghana are readily adapting to the changing needs of customers by embracing innovative solutions. By leveraging technology, developing microinsurance products, and partnering with mobile money providers, they are making insurance coverage more affordable and accessible to a wider population. Insurtech startups are also driving innovation, utilizing advanced technologies to personalize policies and improve overall customer experience. With these advancements, insurance companies are not only meeting the evolving needs of Ghanaians but also contributing to the overall growth and development of the insurance industry in the country.