Insurance companies in Ghana are no longer just traditional businesses providing protection against unforeseen risks. They are now pioneers in innovation and digitalization, revolutionizing the way insurance is accessed and managed in the country. Through the use of technology, these insurance companies are transforming their operations, increasing efficiency, and delivering better experiences to customers.

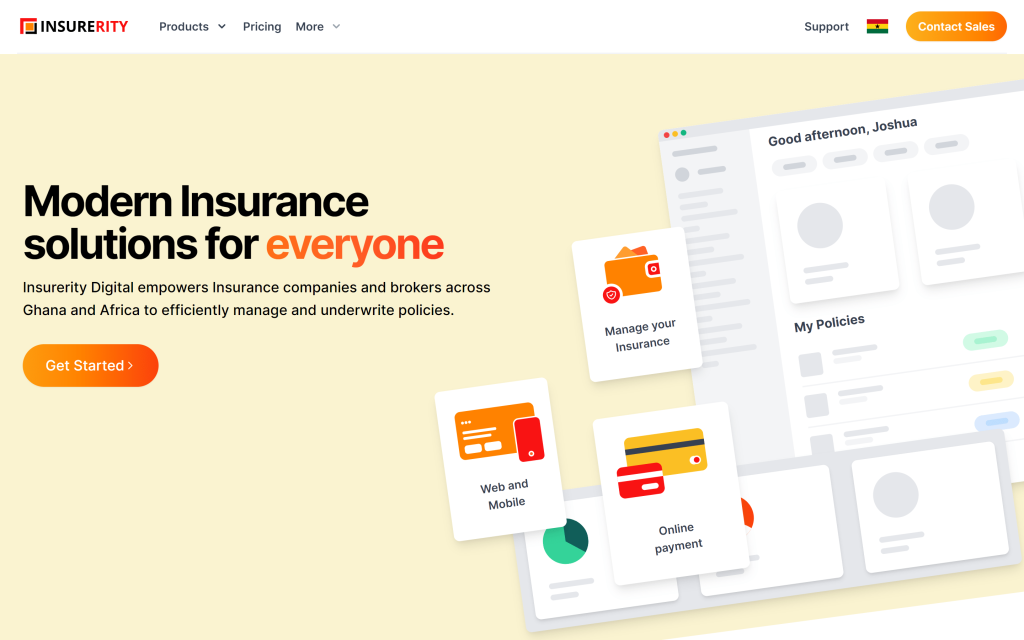

One of the key ways in which insurance companies in Ghana are embracing innovation is through the development of digital platforms and mobile applications. These platforms allow customers to easily purchase insurance policies, make claims, and manage their accounts online. By digitizing these processes, insurance companies are streamlining their operations and reducing the need for manual paperwork, thus saving time and money.

Furthermore, the rise of mobile money in Ghana has provided an opportunity for insurance companies to offer convenient payment options to their customers. Many insurance companies now allow policyholders to pay their premiums through mobile money platforms such as MTN Mobile Money and Vodafone Cash. This not only makes payment easier for customers but also facilitates faster processing of policies, reducing administrative costs for insurers.

Insurance companies in Ghana are also leveraging technology to improve the efficiency and accuracy of their underwriting processes. Through the use of data analytics and machine learning algorithms, insurers are able to assess risk and set insurance premiums more accurately. This not only benefits insurance companies by reducing their exposure to high-risk policies but also helps customers by ensuring they pay fair premiums based on their individual risk profiles.

In addition to digitalization, insurance companies in Ghana are also embracing other forms of innovation to provide value-added services to their customers. One such example is the introduction of insurance-linked savings and investment products. These products combine insurance coverage with investment opportunities, allowing policyholders to grow their wealth while also protecting themselves against unforeseen events. By offering such innovative products, insurance companies are responding to the evolving needs of customers in the country.

The advent of microinsurance has also been a major innovation in the Ghanaian insurance industry. Microinsurance provides coverage to low-income individuals and households who may otherwise be unable to afford traditional insurance policies. Insurance companies in Ghana have collaborated with microfinance institutions and mobile network operators to reach this underserved market segment. Through mobile platforms and micro-insurance products, insurance companies are improving access to insurance and promoting financial inclusion in the country.

The digitalization and innovation efforts by insurance companies in Ghana have not only transformed the way insurance is accessed and managed but have also resulted in increased insurance penetration levels in the country. As more Ghanaians become aware of the convenience and benefits of insurance, the demand for insurance products and services is expected to continue growing.

In conclusion, insurance companies in Ghana are leading the way in innovation and digitalization, leveraging technology to enhance their operations, improve customer experiences, and provide value-added services. The adoption of digital platforms, mobile payment solutions, data analytics, and innovative products have revolutionized the insurance industry in Ghana, making insurance more accessible and affordable for individuals and businesses alike. The pioneering efforts of these insurance companies have not only transformed the industry but also contributed to the overall economic development and financial inclusion in the country.