Breaking down Insurance Premiums: Understanding the Cost Factors in Ghana

Insurance is an essential aspect of managing risk and protecting oneself against potential financial losses. In Ghana, as in many other countries, insurance premiums can vary significantly depending on various factors. It is crucial for individuals and businesses alike to understand these cost factors to make informed decisions about the coverage they need and the premiums they are paying.

1. Type of Insurance: The type of insurance policy you choose plays a significant role in determining the premium cost. There are various types of insurance in Ghana, including auto insurance, health insurance, property insurance, and life insurance. Each category has its risk factors and coverage requirements, resulting in varying premium costs.

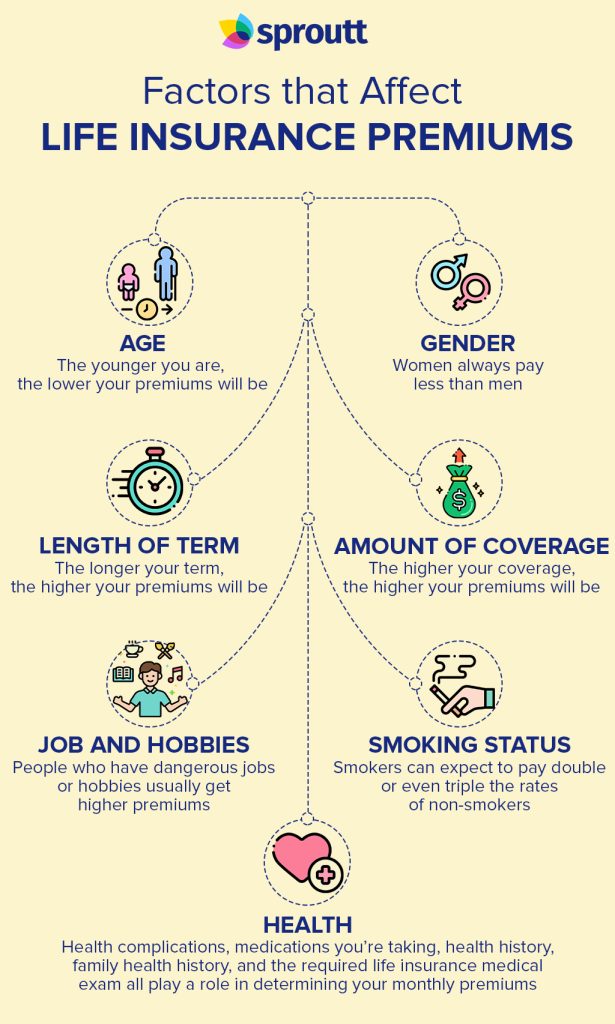

2. Coverage Amount: The amount of coverage you select directly affects the premium price. Higher coverage limits generally lead to higher premiums since the insurance company would be liable for covering more substantial potential losses. Evaluating your specific needs and risk tolerance can help you determine the appropriate coverage amount.

3. Risk Assessment: Insurers assess risk differently, and this evaluation impacts your premium cost. For example, auto insurance premiums heavily rely on factors such as the driver’s age, driving experience, vehicle type, and even the area where you live. Health insurance premiums might depend on factors like age, pre-existing conditions, and lifestyle habits. Evaluating your risk profile against various insurers’ criteria is crucial to finding the best premium rates.

4. Claims History: Insurance companies assess your claims history to determine the likelihood of future claims. Individuals or businesses with a history of frequent claims or high-value claims are seen as higher risks, subsequently resulting in higher premium costs. On the other hand, those without any claim history or with a good claims record may benefit from lower premiums.

5. Deductibles: Deductibles are the portion of a claim that policyholders must pay out of pocket before their insurance coverage kicks in. In general, higher deductibles lead to lower premiums since policyholders share a greater portion of the potential loss. It is important to strike a balance between a deductible that you can comfortably afford and the premium savings it offers.

6. Credit Score: In Ghana, some insurance companies also consider credit scores as part of the premium calculation. The assumption behind this approach is that individuals with higher credit scores are perceived as more financially responsible, thus posing lower risks. Maintaining a good credit score can potentially contribute to lower insurance premiums.

7. Loyalty: Staying with the same insurance company for an extended period may result in discounted premium rates. Some insurers offer loyalty benefits to policyholders who continue renewing their coverage with them. However, it is essential to compare rates from different insurers periodically, as loyalty discounts may not always be the best deal available.

Understanding these cost factors can help Ghanaians make informed decisions when purchasing insurance coverage. It is vital to shop around and compare premium rates from different insurance providers to find the best coverage at the most reasonable price. Remember, insurance is an important investment in safeguarding against unforeseen events, so it is crucial to strike the right balance between appropriate coverage and affordable premiums.